China, the world’s second-largest economy, has emerged as the preeminent force driving the Electric Vehicles (EV) revolution on a global scale. Despite lacking geological abundance in every material essential for the energy transition, China has executed a masterful strategy to establish a monopoly over the EV supply chain, exerting unparalleled influence across the world. Let’s explore how China achieved this significant position.

In the early 2000s, China foresaw the pivotal role of electric vehicles (EVs) globally and strategically positioned itself as a leader. Recognizing the importance of rare earth elements, China secured control, dominating the global EV supply chain. Proactive government policies accelerated EV adoption, solidifying China’s leadership. Through strategic investments in mining and processing, China emerged as a dominant force in the rare earth element market, shaping the future of transportation and advanced technologies worldwide. Before many realized it, China became a world leader in both producing and adopting EVs.

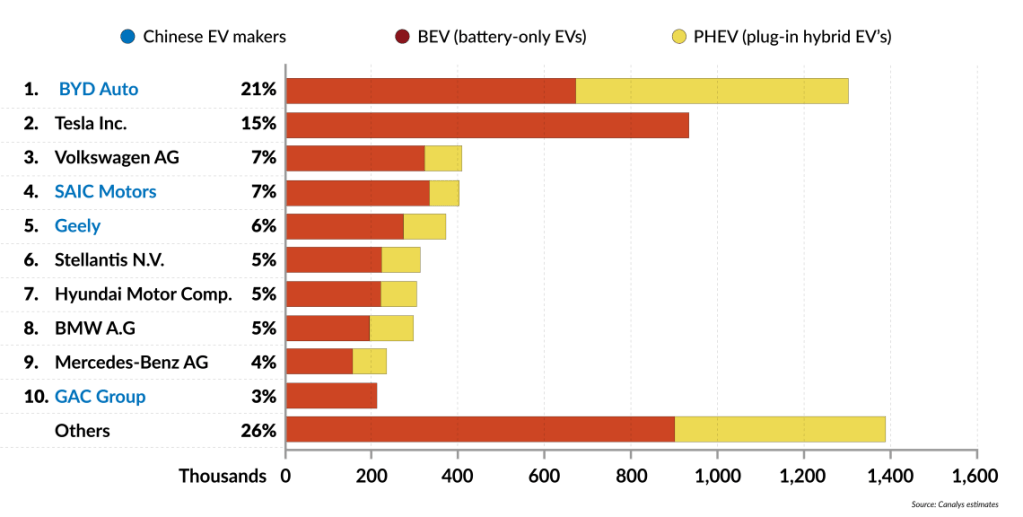

Today, Chinese firms have captured more than 50 percent market of the total global EV market. In addition to the lower cost and advanced technology of Chinese-made EVs, the country also dominates the EV supply chain in ways that will make it difficult for manufacturers elsewhere to compete.

But how does China dominates the EV Market?

1. Total control over the EV Supply Chain

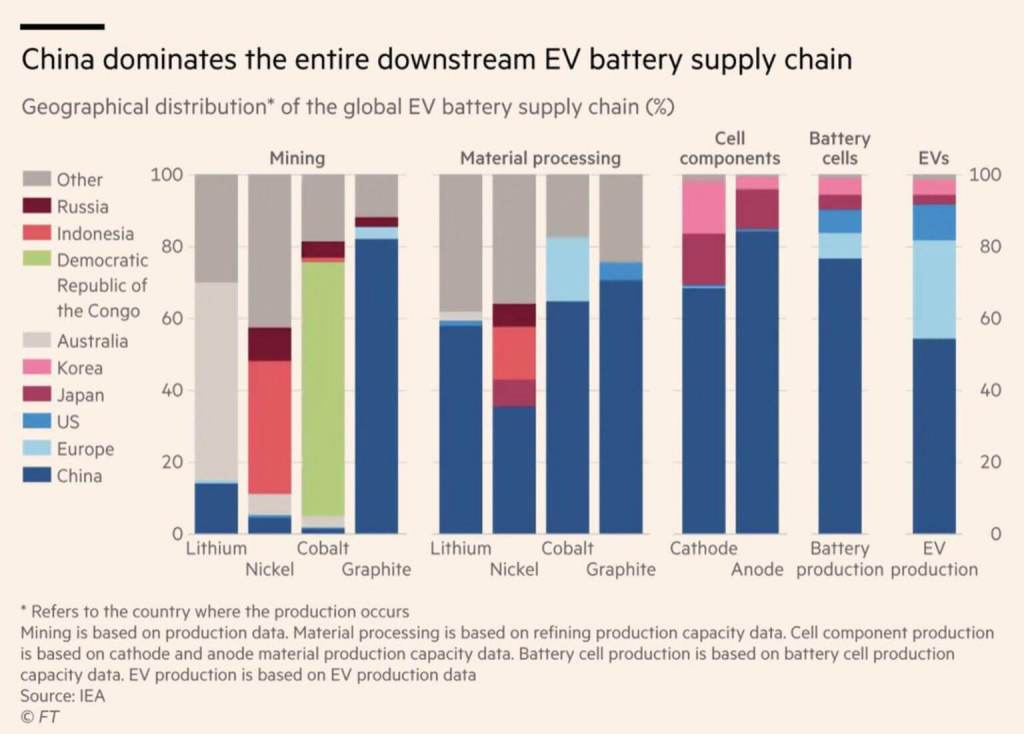

China’s main advantage is EV batteries, the most expensive part of an EV. EV batteries can make up about 40% of the cost of a vehicle. Electric cars use about six times more rare minerals than conventional cars because of the battery.

Lithium, Cobalt, Manganese, Nickel and Graphite are the critical elements required to manufacture a battery. The Chinese EV industry enjoys a proximity to many critical raw material supplies. For example, in 2022 China accounted for 70% of global production of rare earth, a central component for battery production. This signifies that Chinese battery companies control the bottleneck position of the supply chain. China ahead of the time has already invested and acquired stakes in 5 different continents around the world.

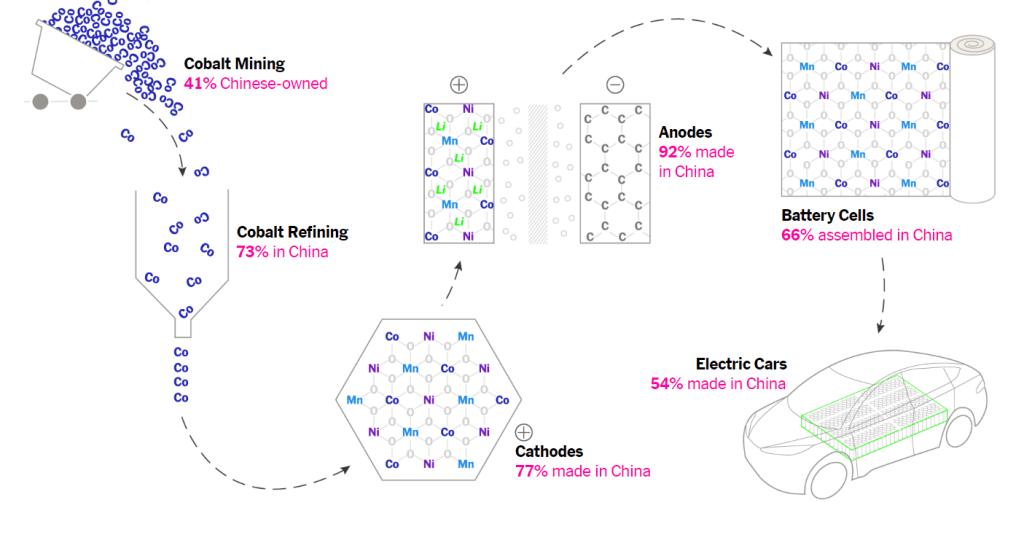

In the vast expanse of the global battery landscape, China has quietly secured a commanding position, playing a strategic hand in the cobalt-rich mines of Congo. According to a New York Times article, China now controls 41 percent of the world’s cobalt mining, and the most mining for lithium, which carries a battery’s electric charge.

Despite larger global supplies of nickel, manganese, and graphite, China’s steady supply, notably in graphite mostly mined within its borders, provides a significant advantage in the battery materials landscape. Further, strategic investments in Indonesia position China to emerge as the leading overseer of nickel production by 2027, as forecasted by consulting firms. In this intricate dance of resources, China is orchestrating its ascent as a powerhouse in the world of battery materials.

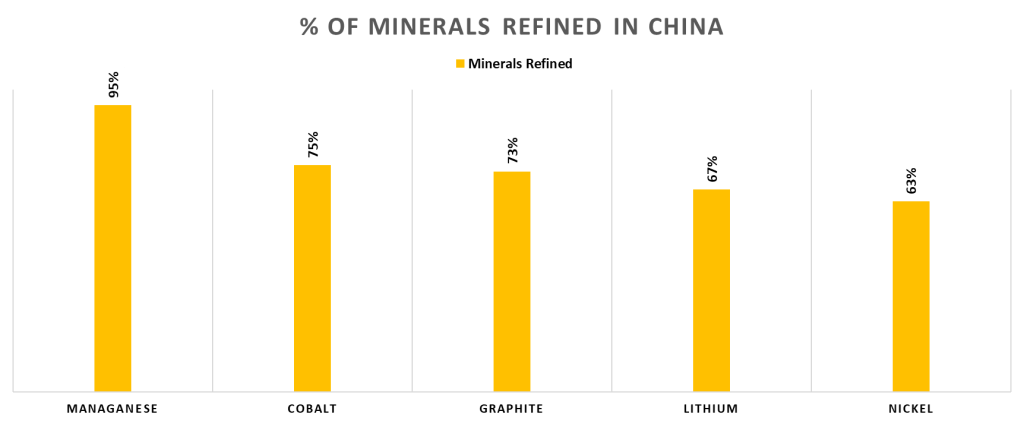

2. Pioneer of Mineral Refining Process

Battery production demands significant energy input, and the refining process plays a crucial role in ensuring high-quality materials. Irrespective of the origin of mineral extraction, a substantial portion is transported to China for the meticulous refining process required to produce battery-grade materials. As highlighted in a New York Times article, China has become a central hub for mineral refining on a global scale.

China’s dominance in refining capabilities underscores its crucial influence in shaping the market for battery-grade materials. These statistics prompt important considerations about the global supply chain’s susceptibility to geopolitical and economic changes. Consequently, China currently produces over 60% of the world’s electric vehicle (EV) batteries.

3. Vertical Integration

The soaring success of China’s foremost automotive players can be attributed to a strategic edge known as Vertical Integration. Rather than relying on external entities for crucial components, these companies have cracked the code to cost-efficient electric vehicle (EV) production by skillfully mastering the art of internal component manufacturing. This self-reliant model not only slashes production costs but also positions these companies to unleash a diverse range of pocket-friendly EVs. Their savvy approach doesn’t stop at cost-effectiveness; it propels them to conquer new frontiers, establishing a robust presence in lucrative markets such as the United States and Europe.

Future of China’s EV Market

China has invested in a cheaper alternative that has now taken half the cathode market. Known as LFP, for lithium iron phosphate, these cathodes use widely available iron and phosphate instead of nickel, manganese, and cobalt. LFP batteries are considered safer than some other lithium-ion battery chemistries. They have a higher thermal stability, reducing the risk of thermal runaway resulting in longer cycle life compared to other lithium-ion batteries, making them suitable for applications where durability is crucial.

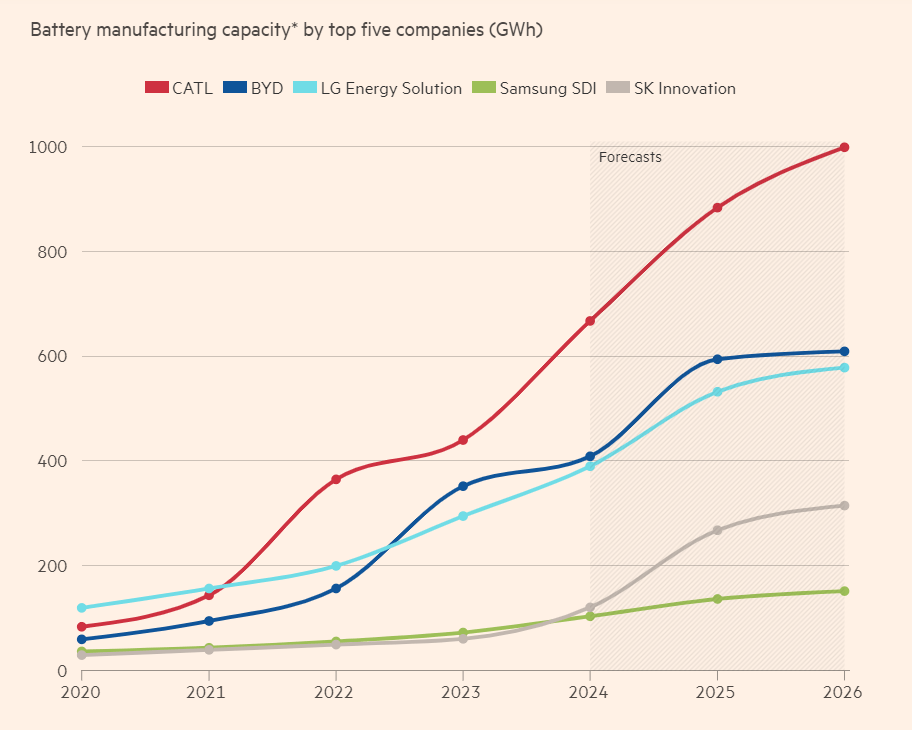

BYD is a Chinese company that is currently leading the EV market worldwide. BYD batteries are among the lowest cost in the world while also boasting close to the highest energy density, which results in better performance in the cars. Tesla and Toyota are customers of BYD’s battery division. Chinese battery manufacturers have expanded internationally far more quickly than EV manufacturers because they supply multinationals as well as Chinese companies. The battery industry is also more concentrated than the automotive one, and some players like CATL have expanded rapidly as demand soars. China’s CATL and BYD are expected to be the two largest battery makers by 2026.

The China Electric Vehicles Market size is estimated at USD 305.57 billion in 2024 and is expected to reach USD 674.27 billion by 2029, growing at a CAGR of 17.15% during the forecast period (2024-2029).

Chinese companies are strategically extending their manufacturing footprint into third countries. Significant investment plans are earmarked for locations in Europe, Southeast Asia, and Brazil. The rationale behind establishing factories beyond China’s borders is closely tied to the growing volume of exports. By producing vehicles and batteries locally, companies can avoid tariffs and high transportation costs, benefit from host government incentives, and mitigate political backlash. This trajectory positions China at the forefront globally, leveraging a proactive approach that sets the stage for continued dominance in the years to come.

“We are confident that China will become the world’s leading market for EVs in the coming years. We are investing heavily in EV development, and we are committed to working with our partners to build a strong and sustainable EV ecosystem.”

–Li Shufu, founder and chairman of Geely

It’s also worth noting that “winning” the EV market can be interpreted in different ways. China might not capture the entire market globally, but it could maintain a strong position in specific regions or segments. Ultimately, the success of any player in the EV space will depend on its ability to adapt, innovate, and address future challenges.

LikeLiked by 1 person

Absolutely, success in the EV market depends on adaptability, innovation, and addressing specific regional or segment needs, not just global dominance.

LikeLike