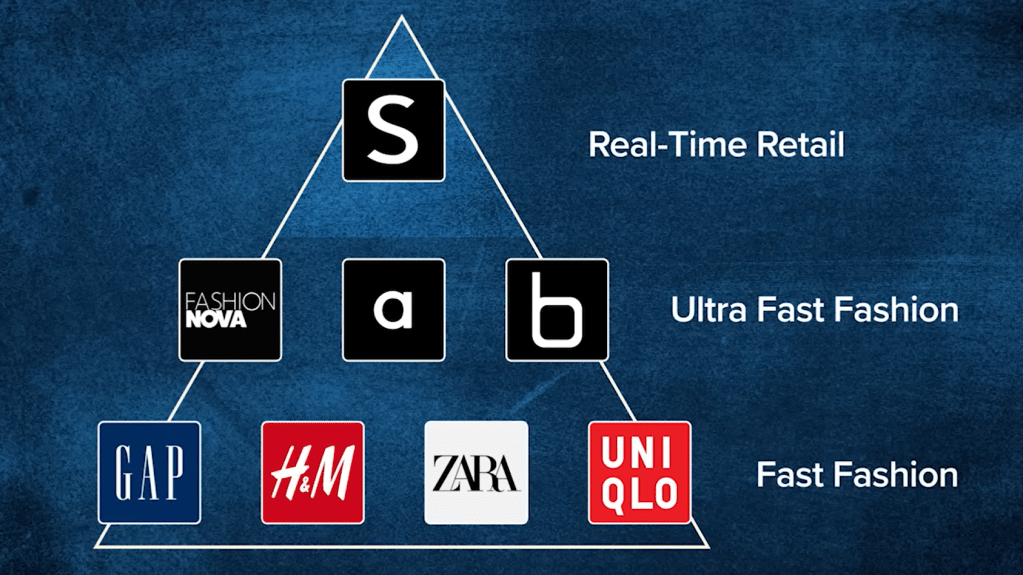

The rise of e-commerce platforms has radically changed shopping habits. This transformation is particularly evident in the fast fashion sector, which boasted a remarkable valuation of $123 billion in 2023. SHEIN, the key player in the fast fashion e-commerce world, renowned for its agile supply chain management has cracked the code to achieve a dominant position at the top. Let us see how did SHEIN beat its competitors at their own game?

Founded in 2012, SHEIN is one of the fastest-growing D2C online retail companies in the world. It specializes in fast fashion offering an extensive range of clothing and fashion accessories and also expanding its product range to include other categories like home decor and electronics, catering to a global customer base.

SHEIN’s explosive growth is driven by its vertically integrated supply chain. Operating a two-sided marketplace, SHEIN engages consumers through targeted digital marketing on platforms like Instagram, Facebook, and TikTok, alongside its own website and apps. Employing strategies such as email marketing, influencer partnerships, and paid advertising, SHEIN reaches specific demographics, initially in the US and expanding worldwide. Meanwhile, SHEIN acts as a crucial intermediary, connecting over 6,000 small clothing factories in China with global consumer demand, facilitating the production of trendy fast-fashion items.

LATR Model: Secret behind SHEIN’s Success

SHEIN operates a highly efficient system known as ”Large-Scale Automated Test and Reorder (LATR) Model”, which forms the backbone of its business model. SHEIN “algorithmically” feeds products to users, adding up to 10,000 individual items and styles to its platform every day. It leverages its data science sophistication to track to customer engagement with its new products. Based on the performance metrics across thousands of new products and trendy designs, SHEIN commissions small initial orders from partnered factories, typically ranging from 100 to 200 units per day. Successful products are automatically reordered and, if proven popular, production quantities are increased.

SHEIN ensures it is only reordering products that have a high probability of succeeding, thereby keeping warehousing costs low, sell-through high, and passing the savings along to the consumer. This approach creates a positive feedback loop where relevant product offerings drive consumer demand, which in turn generates more big data for SHEIN’s supply chain management software allowing the company to monitor the production process and share customer data with suppliers to guide design and production.

According to a BCG report, SHEIN boasts an impressive inventory turnover rate of just 40 days, and its supply chain is twice as fast as its competitors. It has also facilitated global distribution centers and partnerships with last-mile delivery services such as UniUni. Additionally, SHEIN’s commitment to offering affordable prices is evident, with clothing prices estimated to be 39-60% lower than those of competitors like H&M and Zara, according to a 2022 estimate.

In summary, SHEIN’s operational strategies, including its automated test and reorder system, efficient supply chain management, and focus on affordability, contribute to its success as a leading player in the fast-fashion market.

SHEIN Business Strategy

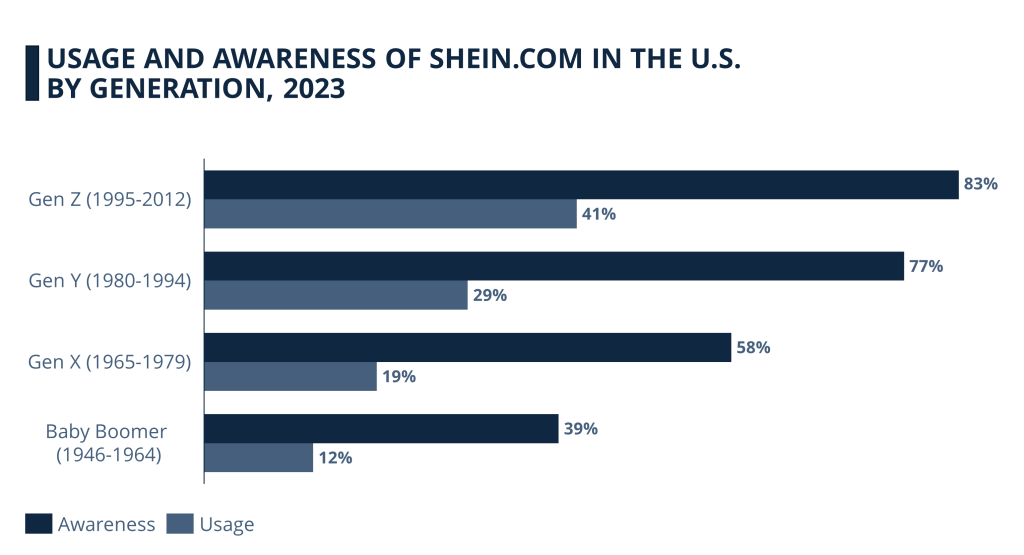

1. Catering to a Younger Audience

SHEIN has gained the highest popularity among Gen Z and Gen Y consumers by tailoring its business strategies and marketing campaigns to align with the preferences of these younger demographics. The company’s success in creating and promoting its products directly correlates with its appeal to younger users. This awareness has also extended to traditional fashion retailers, who, despite emulating some of SHEIN’s techniques, find it challenging to attract a similarly youthful audience.

2. De minims Tax Loophole

This regulation exempts shipments sent to individual buyers in the US from tariffs if their value is below $800. A report from the US House of Representatives reveals that 30% of daily packages entering the United States under this regulation originate from SHEIN and TEMU, amounting to millions of packages.

3. Focus on worldwide Popularity & Expansion

SHEIN continues to move into new geographies creating a impactful cultural phenomenon. In 2022, SHEIN became the most searched fashion brand and became the most downloaded app, surpassing social apps such as TikTok, Instagram, and Twitter, and coming in well ahead of the Amazon app.

SHEIN’s clothes aren’t intended for Chinese customers, but are destined for export. As part of its efforts to broaden its scope beyond China, SHEIN is making strategic investments in warehouses and factories across various global markets. In 2023, the company unveiled a significant move with a $150 million investment in Latin America, designating Brazil as its manufacturing and distribution center for the region. This initiative aligns with SHEIN’s ambitions for expansion in Mexico and other emerging markets.

Currently, SHEIN is an only-digital brand but plans to introduce its omnichannel marketplace model in numerous countries worldwide, showcasing its commitment to global growth and diversification. Additionally, the company’s partnership with key market players in different countries such as Forever 21 in the USA and Reliance Retail in India establishes a domestic e-commerce retail platform that exclusively focuses on offering SHEIN branded products.

In Summary, SHEIN has become the most successful, recognized, and capitalized fast fashion e-retailer worldwide. This is due to its Big data model, rapid response, and price advantage based on the powerful supply chain system, the reverse geographical arbitrage strategy, and the D2C business model based on digital strategies, including social media platforms. Forecasts suggest that SHEIN will continue to see substantial growth in online revenue in the future. Predicted to reach a remarkable US$48 billion in online net sales by 2024, SHEIN is poised to outshine its rivals and dominate the online fashion market.

“The real challenge of supply chain management is to create a competitive advantage for your company”

– Richard J. Schonberger