Waterways serve as the lifeblood of global commerce, facilitating approximately 90% of the world’s trade. This intricate network of maritime routes not only connects continents but also forms the very backbone of international commerce. From bustling ports to vast oceans, the world’s waterways provide the vital arteries through which goods flow, economies thrive, and nations connect. In this blog, we explore the critical role of maritime systems in shaping the global economy and their far-reaching impacts on businesses, industries, and everyday lives.

Suez Canal

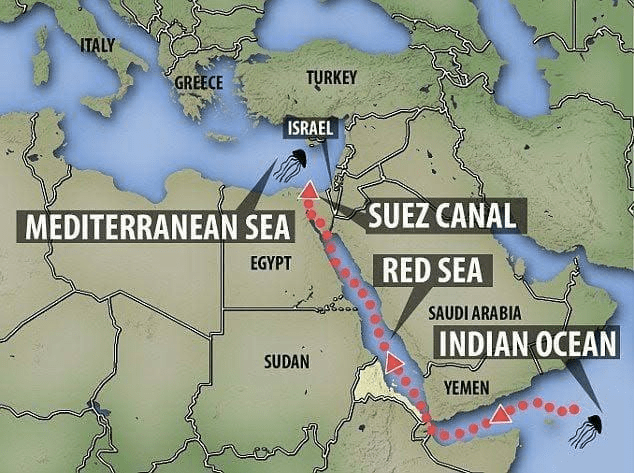

The Suez Canal is a human-made waterway that connects the Mediterranean Sea to the Red Sea, making it the shortest maritime route to Asia from Europe. The channel serves as a vital artery for global supply chains, facilitating the transportation of a wide range of goods. Approximately 12% of the world’s trade, including roughly 30% of global container trade, flows through this key route annually. About 18,000 ships pass through the Suez Canal each year.

Red Sea attacks have disrupted the global trade

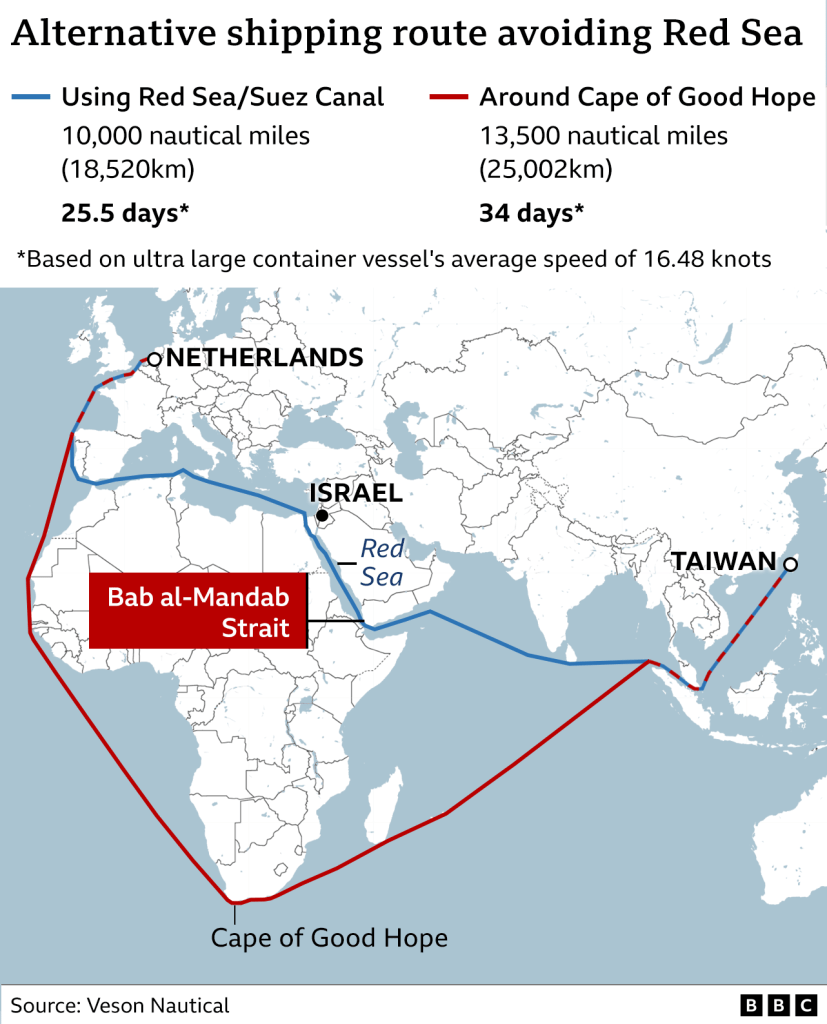

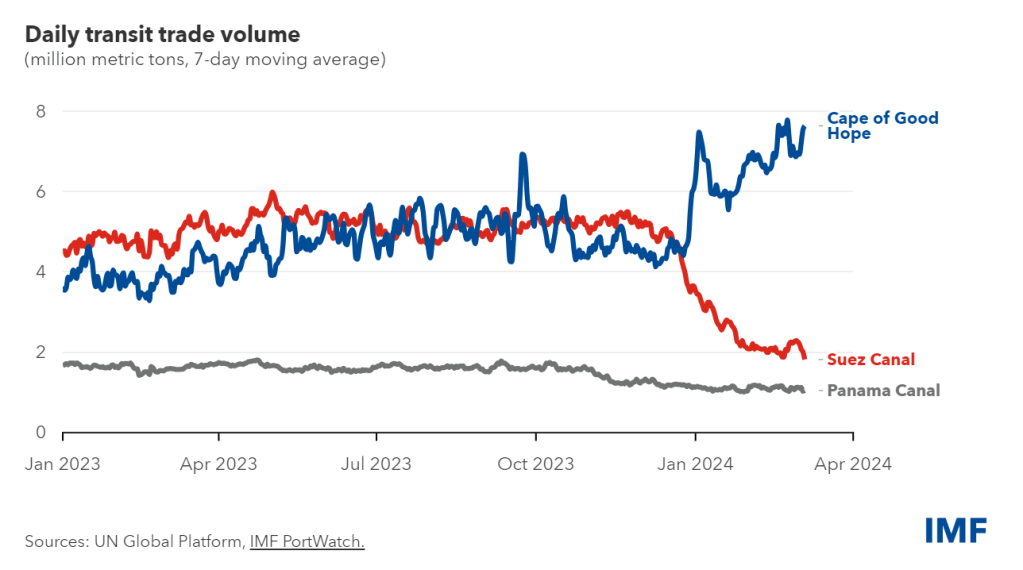

Escalating tensions in the Red Sea, sparked by Yemen-based Houthi attacks since November, have transformed the once vital trade route into a perilous zone. The Shiite military group’s drone and missile assaults, aimed at halting Israel’s Gaza bombardment, are causing significant disruptions and delays in global trade, along with soaring shipping expenses. With an uptick in attacks, numerous companies handling essential raw materials and fuels have ceased operations in the region, opting instead to reroute their vessels an additional 3,500 nautical miles around the Cape of Good Hope in South Africa to ensure safer passage. The safety of shipping in the Red Sea is crucial for the world economy due to its significance as a vital trade route linking Asia, Europe, and the US.

1 Nautical Mile = 1.852 Km

1 Knot = 1.15078 mph (miles per hour)

Recently 3 years back, in March 2021, the global maritime industry was thrown into chaos when one of the largest container ships ever constructed, the Ever Given, became lodged in the Suez Canal, one of the world’s busiest shipping lanes. This massive vessel, nearly twice the size of the Titanic, was stuck in the narrowest section of the canal for six days, resulting in a significant disruption. Over 400 vessels were held up, and nearly $60 billion worth of trade was delayed as efforts to dislodge the Ever Given captured global attention.

Panama Canal

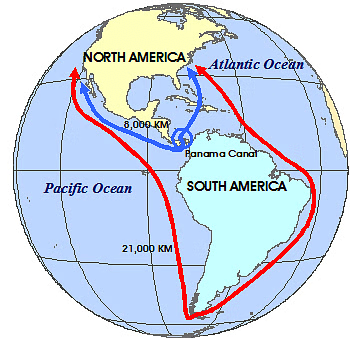

The Panama Canal stands as a critical cornerstone of global maritime transportation, serving as a vital link between the Atlantic and Pacific Oceans. By offering ships an alternative to the lengthy and hazardous journey around Cape Horn at the southern tip of South America, it plays an indispensable role in facilitating efficient trade routes. Spanning more than 40 miles (65 kilometers), with an average transit time of 25 hours per vessel, the canal enables streamlined transportation between the east and west coasts of the Americas. This not only saves significant time and fuel costs but also expedites the delivery of goods, particularly crucial for time-sensitive cargoes, perishable items, and industries reliant on just-in-time supply chains. Approximately 1,000 ships traverse the canal each month, collectively carrying over 40 million tons of goods, representing around 5 percent of global maritime trade volumes.

Extreme Drought in Panama

The Panama Canal faces a critical hurdle with persistent regional drought, causing decreased sea and lake levels vital for operations. This directly impacts global shipping, especially vessels with deeper drafts, as the canal’s capacity dwindles. Typically, the canal accommodates an average of 36 to 38 vessels daily under normal conditions. However, this figure has declined to 24 ships, due to the effects of severe drought conditions, necessitating short-term measures like tapping into secondary reservoirs. Long-term strategies include infrastructure projects like damming rivers and tunneling to maintain water levels in Gatun Lake, ensuring the canal’s viability.

Choosing to navigate around Cape Horn instead of passing through the Panama Canal can be an expensive and time-consuming alternative for ships, as it doubles the distance traveled, leading to increased transit time, fuel consumption, and overall costs. This option becomes particularly unviable in the context of Just-In-Time logistics, where efficiency is crucial. Consequently, the Panama Canal stands to lose an estimated revenue of around 200 million USD as shipping companies explore alternative trade routes. However, opting for longer routes to avoid the canal results in additional costs for shipping companies, which ultimately impact the final product price due to the accumulated expenses incurred throughout the supply chain.

The Ongoing Conflicts: Russia-Ukraine; Israel- Palestine; Iran-Israel

The Russia-Ukraine conflict has heavily impacted global commodity markets, particularly in wheat, metals, and energy. With Russia and Ukraine supplying over 30% of the global wheat market, prices surged by more than 55%. This conflict also affects nickel production crucial for electric vehicle batteries and disrupts the U.S. microchip industry reliant on Ukrainian neon. Precious metal futures spiked, and oil prices exceeded $100 a barrel due to Russia’s significant role as a global oil producer.

The Israel-Hamas conflict has raised concerns about the stability of the International North-South Transport Corridor (INSTC), affecting trade routes connecting India, the Middle East, and Europe. Disruptions could impact logistics for countries like India, Iran, and Russia. Additionally, maritime shipping faces reassessment, potentially affecting Suez Canal routes vital for Europe-Asia trade. Israeli economic impacts include reduced air cargo and temporary business closures, while humanitarian relief efforts increase to address conflict damage.

A conflict between Iran and Israel threatens the global supply chain. Closure of the Strait of Hormuz could restrict oil supplies and increase prices. Heightened military activity may make shipping risky, causing delays and higher costs. Cyberattacks on critical infrastructure could worsen disruptions.

Effect of disrupted Supply Chain

In the initial two months of 2024, trade via the Suez Canal plummeted by 50 percent compared to the preceding year, while trade through the Panama Canal experienced a 32 percent decline. These disruptions have significantly impacted supply chains and distorted key macroeconomic indicators.

Rerouting: A Costly Decision

Rerouting due to canal closures or congestion often entails longer voyages, which in turn result in increased fuel consumption. With fuel prices already a significant expense for shipping companies, these additional costs further strain their budgets and contribute to higher operational expenses. These rerouting decisions create a ripple effect on trade volumes passing through the canal, leading to a notable decrease in transits, reducing canal revenues, and impacting global shipping schedules.

Increased Insurance Fees

War zones, geographical tensions, adverse climatic conditions can lead to extended voyages and alternative routes that can pose greater risks to ships and cargo, prompting insurance companies to adjust their premiums accordingly. This adds another layer of financial burden on shipping companies, as they must now allocate more resources to cover insurance costs, further impacting their bottom line.

Bullwhip Effect

The repercussions of challenges faced by these canals are felt across global supply chains. Increased shipping costs and extended delivery times contribute to higher prices for goods and materials worldwide. For industries reliant on just-in-time delivery models, such as automotive and manufacturing, the delays can lead to production slowdowns and inventory shortages. This again leads to issues in demand forecasting and planning leading to the cause of Bullwhip Effect.

High Delivery Time

Delays in delivery times not only disrupt supply chain schedules but also incur penalties for late shipments. Customers may also seek compensation for missed deadlines or find alternative suppliers, leading to potential revenue loss for shipping companies. Additionally, prolonged delivery times can strain customer relationships and damage reputation, further impacting future business prospects.

In summary, the dynamic nature of global trade necessitates an adaptive approach to supply chain management. Embracing innovation, leveraging technology, and fostering resilience are essential strategies for businesses to navigate today’s complexities and thrive amidst future uncertainties. However, the disruptions we’ve examined underscore the importance of a collective effort. Given the interconnectedness of economies and the myriad challenges we face, it’s imperative to cultivate resilient and flexible supply chains that can withstand geopolitical tensions, environmental pressures, and unforeseen disruptions. By prioritizing visibility, collaboration, and strategic planning, we can work towards a more robust and efficient global trade network that benefits businesses, economies, and communities worldwide.

“You will not find it difficult to prove that battles, campaigns, and even wars have been won or lost primarily because of logistics.”

– Dwight D. Eisenhower

Thanks for sharing this! It’s intresting to see how many outside factors can effect global supply chain initiatives. One thing that caught my attention was the drought in Panama, and how lowering water levels impact water based-transportation methods. Im intrigued to see how companies adapt to these unexpected changes in the future.

LikeLiked by 1 person

Thanks for your feedback! Absolutely, the future of trade via the Panama Canal is something to watch closely. Finding a solution to address the impacts of the drought is crucial moving forward.

LikeLike