In the intricate and ever-evolving world of global finance, Asset Management Companies (AMCs) stand as towering giants, orchestrating the movement of trillions of dollars and wielding unparalleled influence. These financial titans are the architects of the global economic order, directing capital flows, fostering economic development, and promoting sustainable business practices. Understanding the profound impact of AMCs is essential for anyone navigating the complexities of today’s financial landscape. Let’s delve into the world of AMCs, exploring their role as financial powerhouses and how they shape the economic landscape for us all.

What is an Asset Management Company (AMC)?

An Asset Management Company (AMC) is a financial institution that specializes in managing money and investments on behalf of clients. These clients can include individuals, businesses, and other entities ranging from high-net-worth individuals and pension plans to hedge funds and everyday small investors. The primary role of an AMC is to pool funds from clients, invest these funds in a diversified portfolio of assets (such as stocks, bonds, real estate, and other securities), and manage these investments with the goal of achieving specific financial objectives, such as growth, income, or risk management. In return for their services, AMCs charge management fees, which are typically a percentage of the assets under management or a portion of the profits earned.

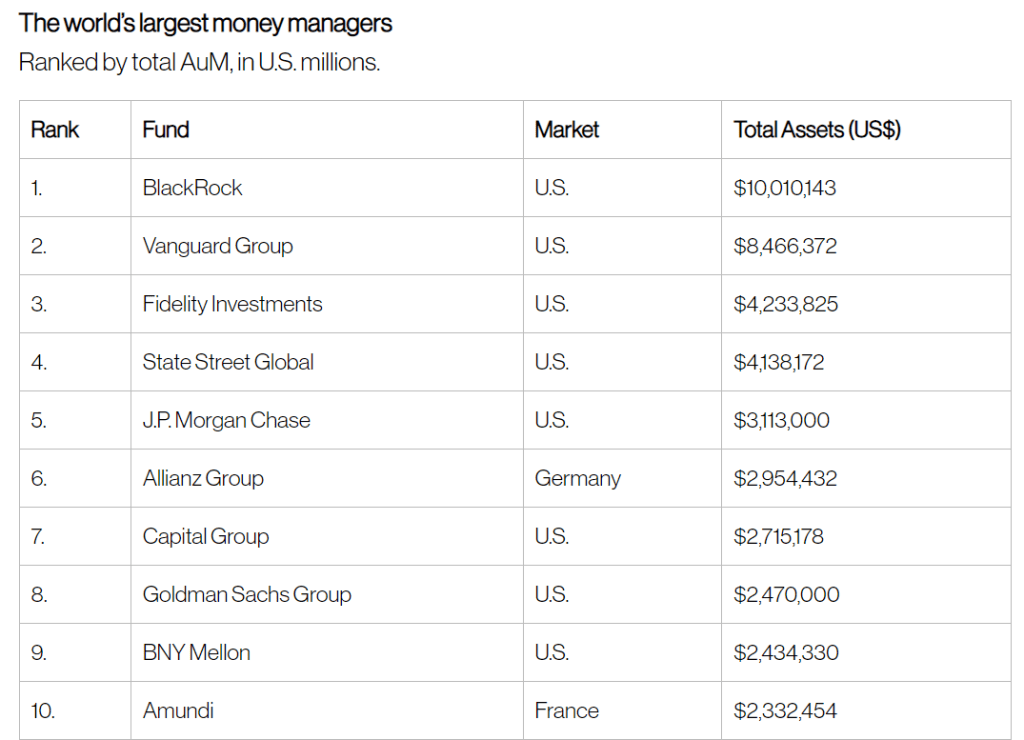

Top AMCs in the world

In 2024, the global Gross Domestic Product (GDP) is estimated at roughly $109.5 trillion USD in nominal terms. BlackRock, the leading financial powerhouse among the asset management companies, oversees a staggering $10 trillion in assets under management (AUM), equivalent to 9.1% of the world’s GDP. To put this into perspective, BlackRock’s AUM surpasses the combined GDP of both Germany ($4.5 trillion) and Japan ($4.1 trillion). This comparison not only underscores BlackRock’s pivotal role in global finance but also highlights the significant impact that asset management companies can have on the economic stage.

How do AMCs influence the Market?

With trillions of dollars under management and significant sway in government circles, the “Big Three” investment firms—BlackRock, Vanguard, and State Street—wield immense economic and political power. Together, they are the largest shareholders in 88 percent of S&P 500 companies and hold substantial stakes in thousands of other corporations, giving them extensive control over the global economy. As of February 2024, Vanguard dominates 30.1% of the equity ETF market, closely followed by BlackRock with 29.4%, and State Street with 14.8%. Collectively, these firms’ funds account for a staggering 74.3% of the entire equity ETF market, underscoring their unparalleled influence in the financial world.

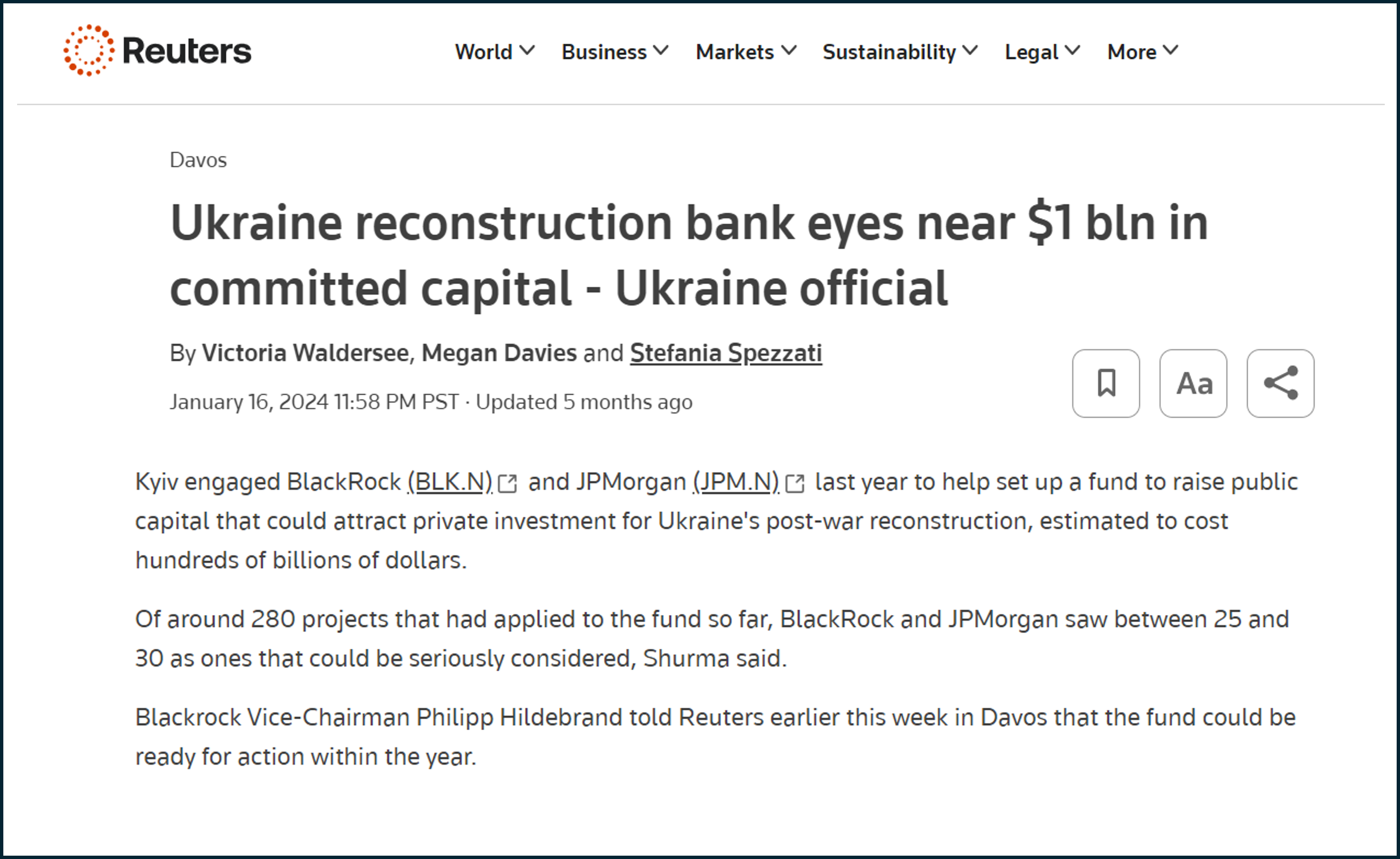

These companies focus on direct, active investments across essential infrastructure sectors such as real estate, housing, energy, utilities, health and hospitals. These sectors are vital to our everyday lives. Unlike passive investing, which simply tracks market indices, their business model involves a more hands-on approach. They focus on quickly and aggressively extracting profits from the companies and assets they acquire, actively managing these investments to maximize returns. This proactive strategy means they play a significant role in shaping the operations and strategies of the businesses they invest in.

Asset Management Companies (AMCs) have a profound influence on global financial markets:

- AUM Size and Scale: Managing trillions in assets, AMCs impact stock prices, bond yields, and commodity prices, shaping global financial markets and economies.

- Ownership Stakes: Significant ownership in major corporations gives AMCs considerable voting power, affecting board elections, executive pay, and corporate policies through proxy voting.

- Corporate Governance: AMCs promote better corporate governance and ESG (Environmental, Social, and Governance) practices, steering companies towards long-term value creation and sustainable strategies.

- Market Impact: Large trades by AMCs can cause market price fluctuations and set trends, such as the rise of passive investing and ESG-focused funds.

- Investment Products: Offering mutual funds, ETFs, and index funds, AMCs provide individual investors with easy access to diversified portfolios, enhancing their market influence.

- Economic Influence: AMCs’ investment decisions shape capital flows and economic stability, indirectly influencing economic policies and regional growth.

While AMCs do not “control the world” in a literal sense, their vast influence over financial markets, corporate governance, and economic policies gives them a significant role in shaping the global economic landscape. Their decisions and actions can have far-reaching consequences, affecting everything from individual investment portfolios to the strategic directions of the world’s largest companies such as Microsoft, NVIDIA and Apple.

AMCs Define & Identify the Direction for the Future Market

Asset management companies (AMCs) are like financial matchmakers, connecting investors with the right opportunities and playing a powerful role in the global economy. They offer professional money management, pool funds for larger investments, and promote diversification to reduce risk, influencing market pricing for efficient capital allocation. This professional management reduces risks and provides liquidity, ensuring market stability and fostering investor confidence. AMCs enable access to a wide range of investment opportunities, benefiting from economies of scale to lower costs. They also support economic development by funding infrastructure and business growth, act as intermediaries to facilitate capital flow, and promote financial literacy and inclusion. In short, AMCs are key players in driving economic growth and stability, making them indispensable for a dynamic and healthy economy.

Asset management leaders focus on a diverse range of sectors to build resilient investment portfolios, including technology, healthcare, financial services, consumer discretionary, energy and utilities, industrials, real estate, consumer staples, telecommunications, and materials. They prioritize sectors poised for growth and innovation, such as technology and healthcare, while also considering defensive sectors like consumer staples for stability. By analyzing market trends, demographic shifts, and regulatory changes, asset management leaders identify promising investment opportunities across various industries to deliver attractive risk-adjusted returns for their clients.

Listening to the CEOs of asset management companies is crucial for gaining deep market insights, understanding strategic directions, and staying informed about industry trends. Their investment decisions can move markets, and their perspectives on global economic conditions, inflation, and market risks are highly regarded. Additionally, their voice in policy discussions can influence regulatory changes and economic policies. As a leading advocate for Environmental, Social, and Governance (ESG) investing, their emphasis on sustainable business practices drives the ESG agenda across the corporate world. With decades of experience and a track record of leadership in finance, their statements are trusted and often seen as a barometer for future market and economic conditions, making their speeches and statements highly anticipated and impactful.

These leaders operate with a quiet power, pulling the strings from the shadows. Their influence, often subtle yet potent extends far beyond the public eye. While they may not engage in daily market theatrics like politicians, their strategic maneuvers exert a profound, behind-the-scenes control over government policies and economic landscapes, shaping the destiny of nations and markets.

“Capitalism has the power to shape society and act as a powerful catalyst for change.”

– Larry Fink

These guys are the real deep state.

LikeLike

True!

LikeLike