Gold has long been a symbol of wealth, power, and enduring value, captivating empires, economies, and investors alike. In today’s volatile economy, marked by fluctuating interest rates and the looming threat of recession, gold’s appeal is stronger than ever. With a 25% surge in demand over the past year, understanding gold’s role as a hedge against inflation and a safe haven is essential. As currencies fluctuate and economic uncertainty looms, let’s explore how this timeless asset can safeguard your wealth in an unpredictable financial landscape.

Known for its limited availability, resistance to rust, malleability, and ductility, gold has consistently maintained its status throughout history. From its use as currency in ancient societies like Egypt and Rome to financing wars and fortifying treasuries, gold has always been trusted. Its rarity and intrinsic value have solidified its role in global trade, finance, and investment—remaining relevant across the ages.

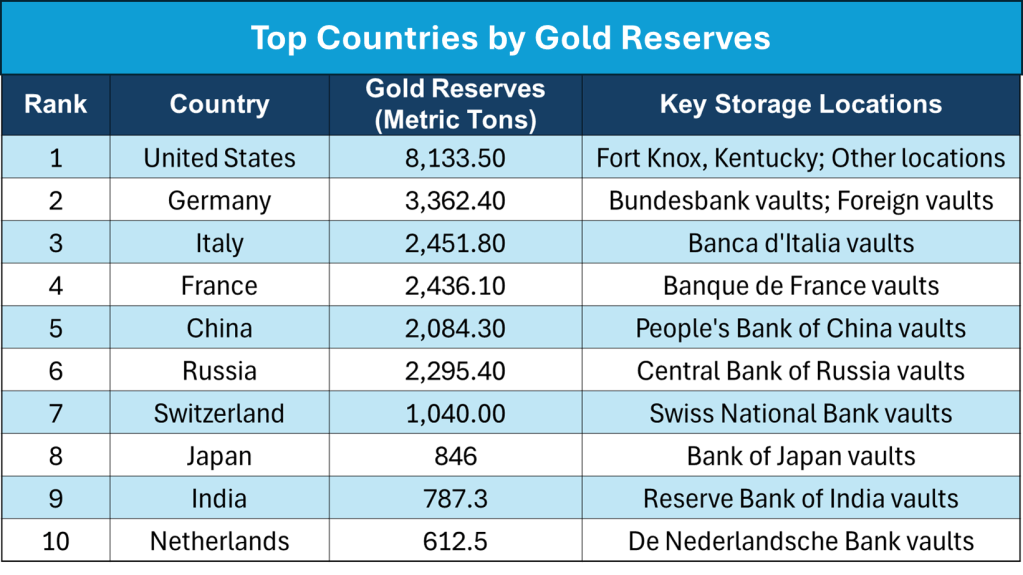

Even today, gold remains a vital hedge against inflation and economic uncertainty. Central banks worldwide hold approximately 20,000 tons of gold reserves to stabilize their currencies and economies. Its industrial applications, particularly in technology and electronics, further emphasize its enduring significance. Additionally, over 50% of the world’s gold is crafted into jewelry, symbolizing wealth and cultural heritage, reinforcing its dual role as both a valuable investment and a cultural asset.

Gold’s Role in USA’s Global Economic Dominance

Gold was vital to the USA’s rise as a superpower in the 19th and early 20th centuries. The California Gold Rush of 1848 spurred rapid economic growth, infrastructure development, and westward expansion, significantly boosting the nation’s economic strength. In 1879, the USA adopted the gold standard, linking the dollar’s value to gold. This ensured economic stability and credibility, enhancing global trade and investment.

After World War II, the USA held about 75% of the world’s gold reserves, which was crucial in establishing the Bretton Woods Agreement in 1944. This agreement, signed by 44 nations, created the International Monetary Fund (IMF) and the World Bank. It also pegged global currencies to the US dollar, convertible to gold at $35 per ounce, solidifying the dollar as the world’s reserve currency and boosting the USA’s global economic dominance. Though the gold standard ended in 1971, its legacy was crucial in cementing the USA’s status as a global superpower.

Extraordinary Global Demand for Gold

Today, China, India, and the USA are the top three gold consumers, each driven by distinct motivations that reflect their economic landscapes and cultural values.

China’s significant gold purchases are driven by the need for economic stability and diversification of foreign reserves. Strengthening ties with Russia and rising geopolitical tensions with the U.S. are prompting China to reduce its reliance on the dollar. Economic challenges, such as a slowing stock market and real estate sector issues, have heightened demand for gold as a safer investment. By increasing its gold reserves, China seeks to protect against inflation and currency fluctuations while bolstering confidence in the yuan. This strategy not only solidifies China’s position in the global financial landscape but also reflects its long-term goal of achieving greater financial independence from Western economies.

In India, gold is deeply embedded in cultural traditions, especially in weddings and festivals, where it symbolizes wealth and prosperity. Many Indians also see gold as a reliable hedge against inflation and currency devaluation, contributing to its widespread use as a traditional investment. The expanding middle class, coupled with economic instability and government policies supporting gold imports, further drives demand.

India Gold Rate since 1965 – BankBazaar

USA Gold Rate since 1965 – Trading Economics

In the USA, gold serves as a safe-haven asset, with demand spiking during periods of economic uncertainty like financial crises or inflationary pressures, reinforcing its role in personal investments and central bank reserves. These varied motivations underline why gold continues to maintain extraordinary global demand.

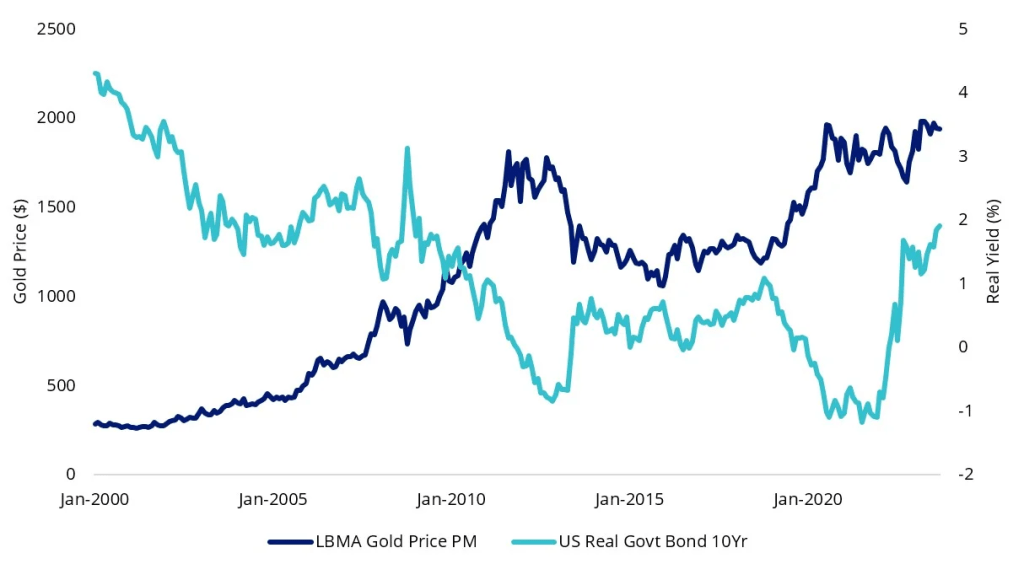

Interest Rates vs. Gold Prices

Interest rates and gold prices exhibit an inverse relationship. When interest rates rise, the opportunity cost of holding gold increases because investors can earn more from interest-bearing assets such as bonds and savings accounts. This leads to decreased demand for gold and lower prices. Conversely, when interest rates are lower, concerns about inflation may prompt investors to buy gold as a hedge, driving its price up.

Following the Federal Reserve’s announcement of a 50 basis point cut in interest rates on September 18, 2024, gold prices surged to an all-time high. This spike reflects not only increased demand for gold as a safe haven but also signals a decline in the value of the U.S. dollar. Such movements are often seen as indicators of potential economic recession, as investors seek to protect their assets amid concerns about economic stability.

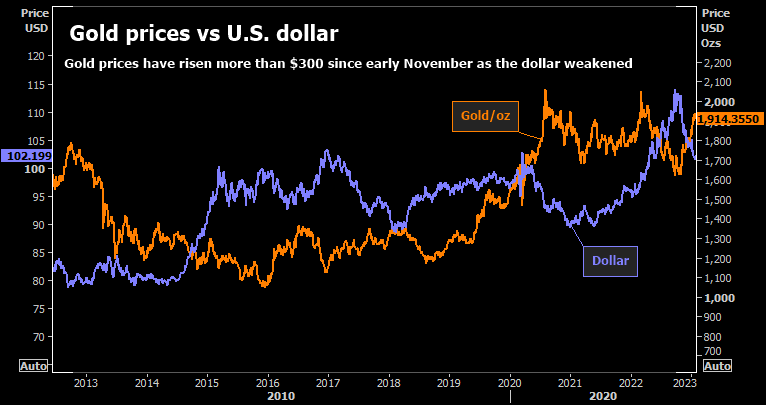

U.S. Dollar vs. Gold Price

The value of the U.S. dollar and gold prices have an inverse relationship, meaning that when the dollar weakens, gold prices tend to rise, and vice versa. This occurs because gold is priced in dollars; therefore, a weaker dollar makes gold less expensive for buyers using other currencies. As a result, foreign demand for gold increases, driving its price up.

For instance, when the dollar declines in value, countries like China take advantage of lower gold prices to increase their purchases. This not only allows them to acquire more gold for their reserves but also acts as a hedge against economic uncertainty and inflation risks. Conversely, when the dollar strengthens, gold becomes more expensive for foreign buyers, which can decrease demand and lower gold prices.

Gold is an Indicator of Recession

Rising gold prices can signal that the economy is unstable or heading for a recession. During tough times, investors tend to buy gold as a safe haven, increasing its demand. Recessions often bring worries about inflation and currency value, which leads people to buy more gold to protect their wealth. Central banks may also increase their gold reserves during these periods, pushing prices higher.

Gold has historically outperformed the S&P 500 by an average of 37% in six of the last eight recessions. Its role as a safe asset becomes more important during uncertain times. Investors see gold as a way to guard against inflation, especially when central banks lower interest rates, making other assets less appealing. Overall, gold prices tend to go up during economic difficulties, reflecting market trends and serving as a good sign of potential recessions.

CONCLUSION

As economic indicators such as rising unemployment, declining GDP, or falling consumer confidence emerge, the uptick in gold prices often signals that a recession may be on the horizon. For investors, monitoring gold can provide critical insights into economic conditions, helping to inform strategic decisions in uncertain times. As gold continues to shine as a beacon of stability, its role as a barometer for recession is well-established. Will you take advantage of gold’s enduring strength in your investment strategy?

Governments lie; bankers lie; even auditors sometimes lie. Gold tells the truth.

– William Rees-Mogg