Credit cards, often referred to as ‘plastic money,’ have become a significant part of the American financial landscape. With total credit card debt in the U.S. surpassing a staggering $1.17 trillion, it’s evident that credit cards play a powerful role in shaping our financial lives. However, beneath their convenience lies a double-edged sword. While they offer flexibility and rewards, they can also lead to crippling debt and financial hardship if not managed responsibly. Let’s dive deeper to explore the complexities of the credit card game.

A credit card is a financial tool that enables users to buy goods or services on credit, creating a short-term debt that must be repaid within a specified period. Failure to repay on time incurs hefty penalties, commonly referred to as interest.

The Consumer Psychology Behind Credit Cards

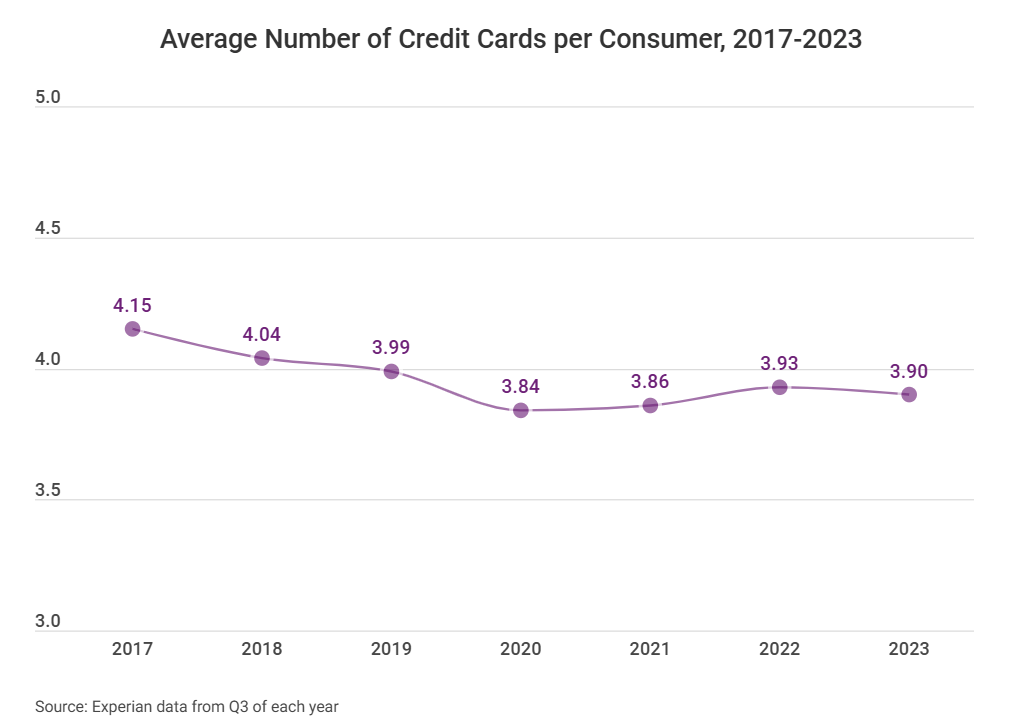

The average American now holds 4 Credit Cards. Credit card companies invest heavily in understanding human behavior, and it’s no accident that consumers are bombarded with enticing offers like “0% APR for the first 15 months.” The psychology behind credit cards is simple yet powerful: they make spending feel painless.

Studies reveal that people tend to spend 20-30% more with credit cards compared to cash, often referred to as the “credit card premium.” This is because, unlike cash, which carries tangible value and creates an immediate sense of loss when spent, credit cards detach the consumer from the real-time financial impact of their purchases. Features like Fast Checkouts and Buy Now, Pay Later (BNPL) options amplify this effect, eliminating friction and delaying financial consequences, which encourages impulsive purchases. According to a report by Adobe Analytics, consumers are expected to increase their spending by 11.4% this holiday season through Buy Now, Pay Later options compared to the previous year.

Rewards Cards: A Drug to the Consumer

Rewards credit cards take the spending incentive one step further by offering tempting perks like cashback, travel points, airport lounge access and exclusive discounts. These rewards programs serve as a psychological hook, enticing consumers with the promise of added value for their purchases.

While the general psychology of credit cards makes spending feel effortless, rewards cards add an additional layer of reinforcement. The more consumers swipe, the more benefits they accrue, leading to a cycle of excessive spending. What initially appears as a benefit often becomes a financial trap, with consumers increasingly dependent on rewards to justify further purchases. Banks design these programs to keep consumers engaged, while subtly diverting attention from high-interest rates and hidden fees. This constant spending often pushes consumers deeper into debt.

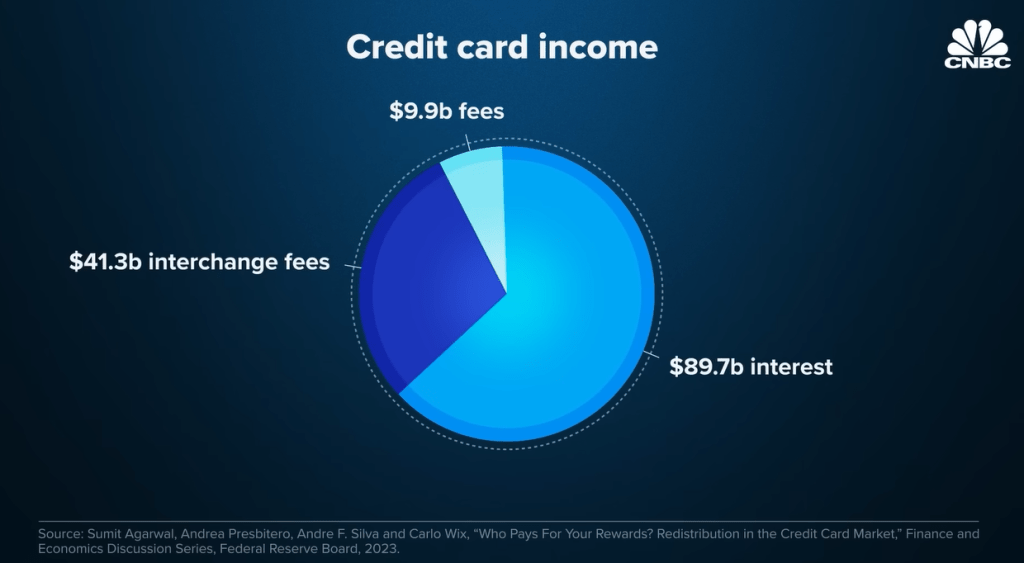

According to a CNBC article, credit card companies generated over $140 billion in revenue in 2019, with more than half ($70 billion) coming from rewards cards. This segment of the industry is highly profitable because consumers using rewards cards tend to spend more, accumulate more debt, and default at higher rates. As a result, the system creates a redistribution of wealth, where billions in interest payments flow from lower-income consumers to those with higher credit scores, further deepening economic inequalities. While rewards programs may appear enticing, they are a key factor in perpetuating the debt cycle, benefiting credit card companies at the expense of financially vulnerable individuals.

Companies Make Billions in Profits, Consumers Accumulate Trillions in Debts

The Visa-Mastercard duopoly controls 80% of credit card transactions, with a combined market cap exceeding $1 trillion. These financial giants maintain over 50% profit margins, fueling their immense revenue streams while consumers face mounting debt.

The average credit card interest rate stands at 22%, with some cards charging an even higher average APR of 28.75%. These high rates are compounded by penalties, further entangling consumers in debt. Despite these alarming figures, there are currently no legal caps on the fees or interest rates credit card issuers can impose, leaving consumers vulnerable to exploitation.

The credit card industry’s evolution reveals predatory practices targeting high-risk borrowers.. These strategies, focused on profiting from penalty fees and high-interest rates, ensnared millions of low-income Americans, contributing to the 2008 financial crisis. Many refinanced credit card debt into subprime mortgages, deepening their financial struggles during economic downturns. Despite calls for reform, powerful lobbying has hindered meaningful legislative change.

Gen Z is drowning in Credit Card Debt

Younger generations, especially Gen Z and Millennials, are grappling with severe financial hardships fueled by debt, inflation, stagnant wages, and rising living costs. Unlike Boomers and Gen X, whose incomes better matched expenses, today’s young adults face lower inflation-adjusted earnings, higher debt-to-income ratios, and surging housing and tuition costs.

Gen X holds the highest amount of credit card debt compared to other generations, including millennials, boomers, and Gen Z. However, Gen Z reports feeling the most overwhelmed by their debt. Among those who have credit card debt, around two-thirds describe it as “unmanageable.” When factoring in student debt, it’s evident that younger generations are facing significant financial challenges, possibly more than ever before.

Credit cards have become a financial lifeline, with Gen Z experiencing the fastest-growing debt. Crushing student loans and unattainable housing force many to delay major financial decisions, heightening stress. Adding to this burden is “doom spending,” where despair triggers impulsive purchases, deepening the debt trap and perpetuating financial instability.

CONCLUSION: Sourcing Profits from the Poor and Delivering Them to the Rich

The credit card industry has mastered the art of profiting from those least able to afford it. With 65% of Americans living paycheck to paycheck, factors such as inflation, unemployment, layoffs, rising interest rates, and other external pressures are pushing individuals further into debt. The ease of using plastic money fosters impulsive spending, making it even more difficult for individuals to save. In a capitalist society, we must ask: is anything truly offered without a catch? The credit card industry thrives by exploiting financial vulnerability, funneling wealth from those struggling to those already financially secure, thereby deepening the divide between the rich and the poor.

“You don’t build wealth with credit card rewards and airline miles. You can’t beat the credit card companies at their own game.”

– Dave Ramsey