In the world of business, understanding consumer behavior is crucial. Every decision, whether buying a product, choosing a service, or negotiating a deal, is influenced by psychological and economic factors. Businesses, politicians, companies, policymakers, and media leverage behavioral economics to refine marketing strategies, optimize customer experiences, and influence decision-making. As neuroscience, psychology, and behavioral economics converge, they are reshaping how we think and act in an increasingly data-driven world. Let’s explore how behavioral economics influences decision-making and why human choices are far from perfectly rational.

Traditional Economics Vs Behavioral Economics

Traditional economics assumes that humans are perfectly rational decision-makers who act based on logic, self-interest, and complete information.

However, behavioral economics challenges this view. In reality, our choices are often shaped by emotions, mental shortcuts, and cognitive biases. Traps like loss aversion, confirmation bias, and present bias can lead us to make poor decisions. This shift has significant implications, revealing how choices can be manipulated, influenced, predicted, and even improved using insights from psychology.

Cognitive Biases: The Invisible Influencers

The human mind often relies on mental shortcuts, called heuristics, to make quick decisions. While useful in many situations, these shortcuts can also lead to consistent errors in judgment, known as cognitive biases. These biases help explain why people sometimes make irrational or suboptimal decisions.

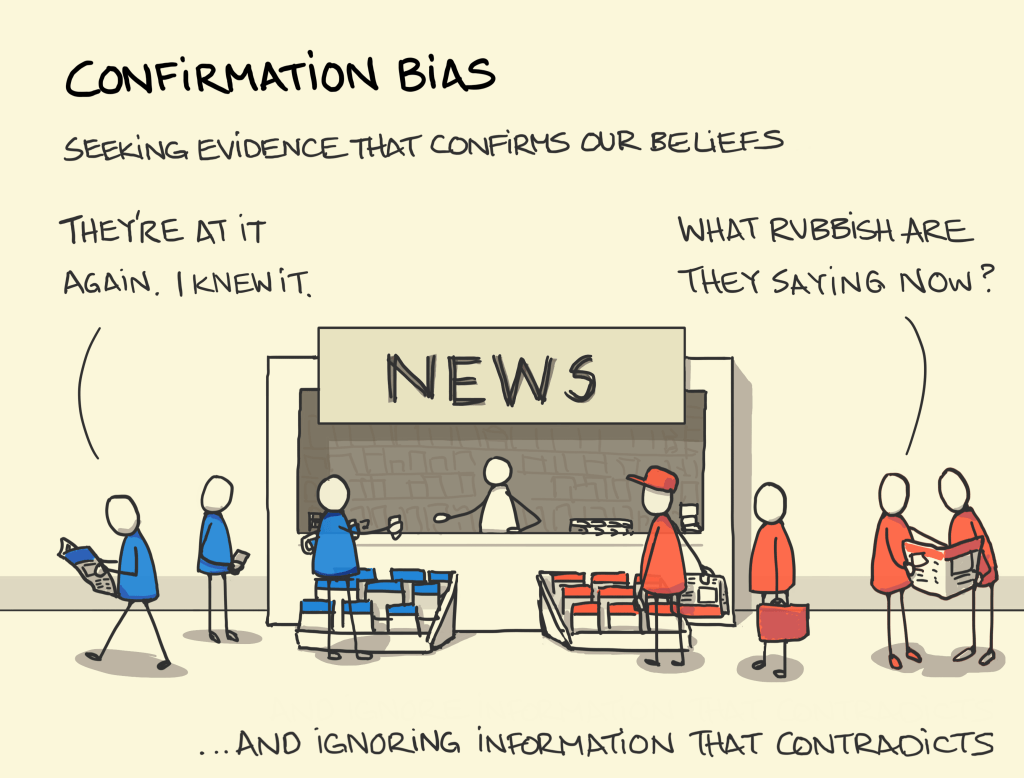

1. Confirmation Bias: Reinforcing Beliefs

People tend to seek, interpret, and remember information in ways that confirm their existing beliefs or hypotheses—a tendency known as confirmation bias.

In politics, confirmation bias plays a crucial role. People naturally gravitate toward news and opinions that align with their existing beliefs, often disregarding opposing viewpoints. This tendency is amplified by news media, TV channels, and social media platforms that cater to specific political ideologies, deepening the divide. For example, a left-wing individual may gravitate toward progressive news outlets, while a right-wing person may prefer conservative media. Over time, this selective exposure creates echo chambers, where beliefs are reinforced and neutral perspectives become increasingly rare. This can lead to skewed reasoning and poor decision-making by ignoring contradictory evidence. To counter this, independent and critical thinking is essential. Challenging our own views and engaging with diverse perspectives leads to more informed, balanced opinions.

2. Loss Aversion: Fear of Loss > Gain

Pain from Loss = 2 x Pleasure from Gain

Loss aversion theory suggests people fear losses twice as much as equivalent gains. This explains why investors hesitate to sell underperforming stocks, hoping they will recover instead of accepting a loss. For example, if someone buys a stock at $100 and it drops to $80, they might hold onto it, hoping it bounces back just to avoid realizing the loss. Emotion overrides logic, often leading to even bigger losses. This bias explains why people avoid risks, cling to bad decisions, or overpay for security.

Marketers often capitalize on loss aversion by using tactics like limited-time offers, free trials, credit card reward programs, and money-back guarantees to trigger a fear of missing out. These strategies play on our fear of losing opportunities, even when it may not be in our best interest.

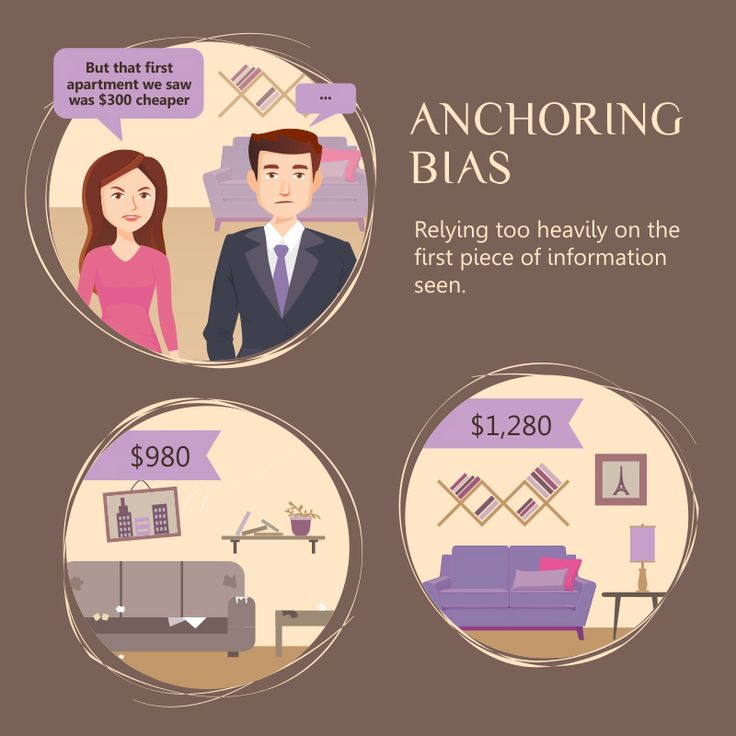

3. Anchoring: The First Number Sets the Tone

Consumers rely heavily on the first piece of information they receive when making decisions, and businesses exploit this by setting high initial prices before offering discounts.

Retailers often use the “$X.99” pricing trick to make products feel cheaper than they are. This globally used tactic plays on what’s called the Left-Digit Effect—our brains instinctively focus on the first number we see. So, $49.99 feels closer to $40 than $50, even though it’s just a cent less. It’s not logic—it’s perception. That’s why prices like $19.99 or $99.99 are everywhere: they create the illusion of a better deal, prompting us to buy without a second thought.

IKEA is a classic example of anchoring bias. When you enter the store, you might first see a luxurious sofa priced at $1,000, which sets a high anchor in your mind. As you walk further, a simpler sofa priced at $450 suddenly feels like a bargain—even if you hadn’t planned to buy one. Similarly, a $9.99 lamp placed next to a $50 table appears affordable by comparison. These pricing strategies are especially prevalent during events like Black Friday, where initial anchor prices create the illusion of bigger discounts, driving more purchases.

Nudge Theory: Reshaping the “Choice Architecture”

Nudge Theory is the idea of presenting choices in a way that subconsciously influences people’s decisions, without enforcing them. It leverages cognitive biases to reshape the “choice architecture” by structuring how options are presented, guiding people toward better decisions while still preserving their freedom.

For example, in countries like Spain, organ donation follows an opt-out system, where individuals are automatically considered organ donors unless they actively choose to opt out. This approach uses Nudge Theory by making organ donation the default option, which people are more likely to accept due to inertia. This system significantly boosts organ donation rates compared to opt-in systems, where individuals must actively choose to donate.

- Healthy Eating: Placing fruits at eye level in a cafeteria increases the chances people will choose them over junk food, without eliminating other options.

- Savings Plans: Automatically enrolling employees in retirement plans (with an option to opt out) significantly increases participation rates.

- Tax Compliance: Telling people that “most of your neighbors have already paid their taxes” nudges them to do the same through social proof.

- Online Shopping: Showing “Only 2 left in stock!” or “Best Seller” tags nudges buyers to act quickly, increasing sales.

- Eco-Friendly Choices: Placing paper bags in visible spots encourages customers to choose them over plastic.

Conclusion

Behavioral economics reveals how cognitive biases, social norms, psychological triggers, sensory cues like color, and biological factors such as age and brain development (like the prefrontal cortex) shape our decisions. It shows that people are not always rational, but predictably irrational.

By leveraging insights such as nudges, social influence, and mental shortcuts, businesses and policymakers can design smarter strategies that benefit both individuals and society. In today’s data-driven world, understanding the psychology and biology behind decision-making isn’t just useful—it’s a competitive advantage. The future belongs to those who can decode the irrational mind.

“Humans satisfice, not optimize.”

— Herbert A. Simon (Nobel laureate)